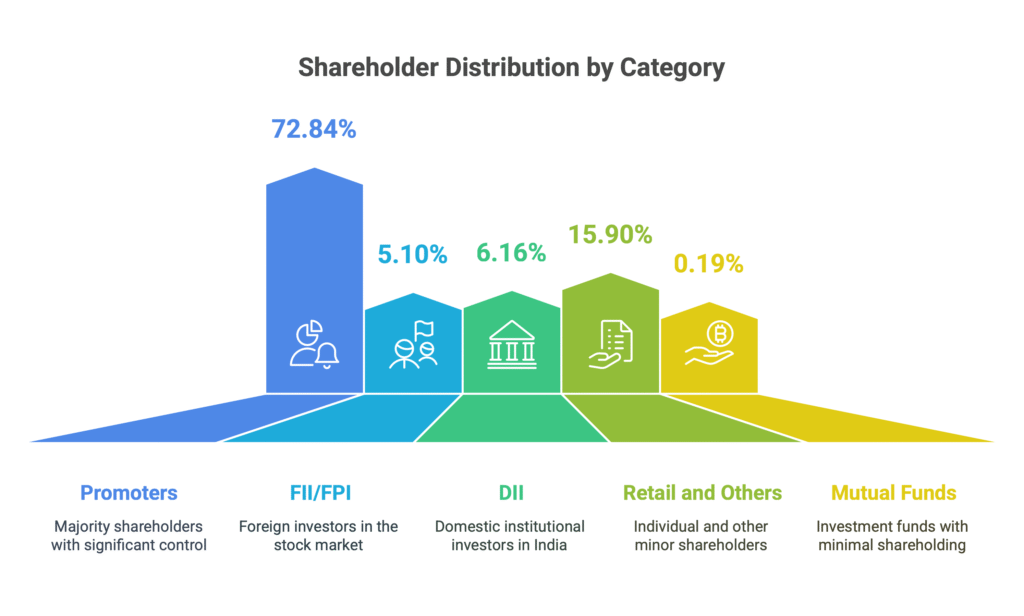

TOTAL SHARE HOLDING OF RVNL (RAIL VIKAS NIGAM LIMITED)

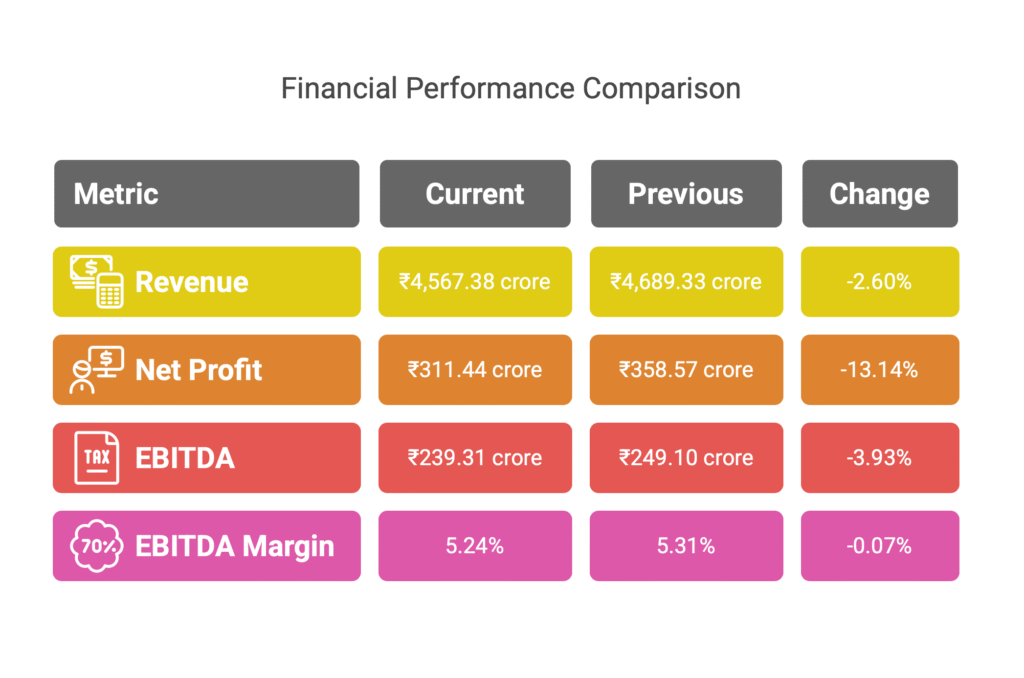

FINANCIAL OF RVNL (RAIL VIKAS NIGAM LIMITED)

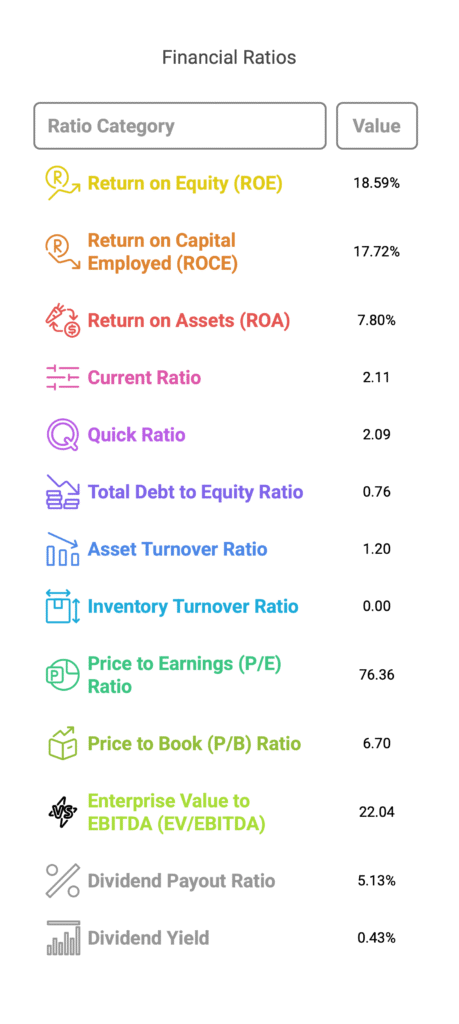

FUNDAMENTAL OF RVNL (RAIL VIKAS NIGAM LIMITED)

As of the fiscal year ending March 31, 2024, here are the key financial ratios for Rail Vikas Nigam Limited (RVNL):

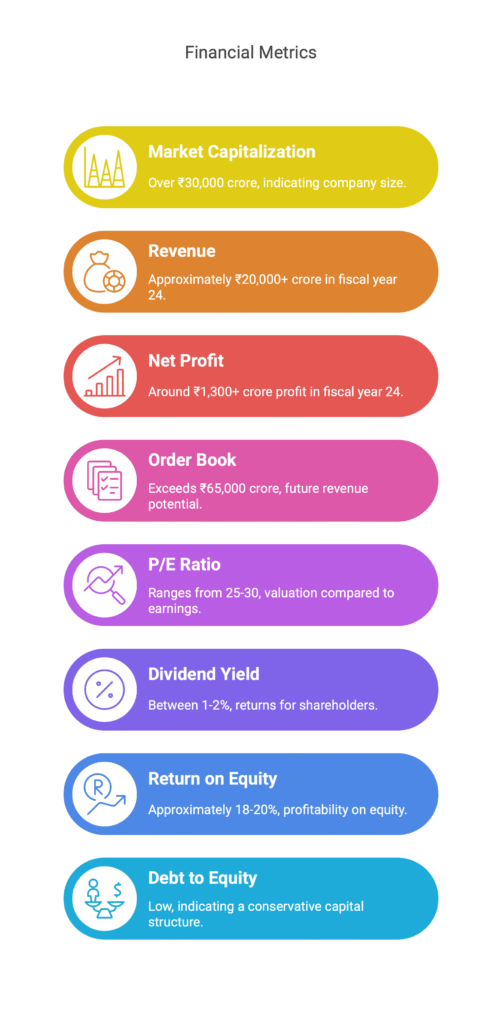

Key points of RVNL (RAIL VIKAS NIGAM LIMITED)

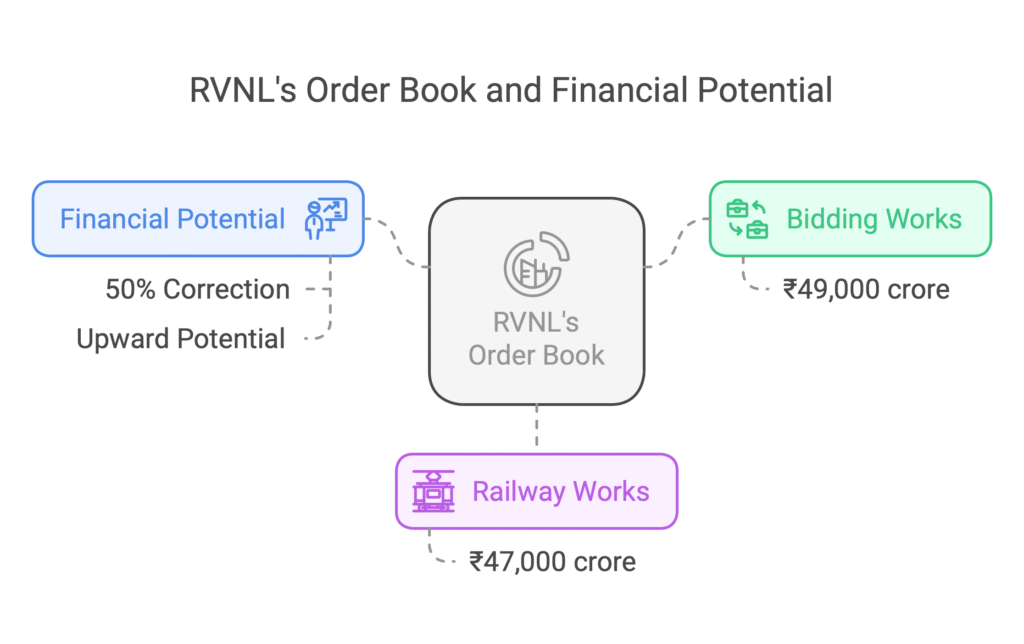

As of March 25, 2025, Rail Vikas Nigam Limited (RVNL) maintains a robust order book valued at approximately ₹97,000 crore. This substantial order book includes:

Bidding Works: ₹49,000 crore

Railway Works: ₹47,000 crore

This diversified portfolio underscores RVNL’s significant role in India’s infrastructure development and provides a strong foundation for its future revenue streams.This share has corrected up to 50% from all time high and it has potential to move upward so you can consider this stock in your portfolio for long-term .

CONS of RVNL (RAIL VIKAS NIGAM LIMITED)

Dependencies on government. Government policies.profit margins. dependence on Indian railway government controls low margins project delays competition from private players concentration risk, market risk geopolitical risk dependence on external contractors high working capital requirement.

Declaration

This blog is for educational purpose, and not to the recommendation to buy this stock before buying this stock. Contact your financial advisor and do your own research.

Also Read These Railway Stocks:-

- BHEL : Bharat Heavy Electrical Limited

- IRCTC 2025 :Indian Railway catering and tourism corporation share – A multi bagger railway stock.

- Container Corporation Of India a leading Railway Stock having multi Bagger potential (CONCOR)

- Taxmaco Rail & Engineering Limited : A multi Bagger Railway Stock To Invest In 2025

- IRFC : Indian railway finance corporation a multi bagger railway stock to invest in 2025